The Basic Principles Of Dubai Company Expert Services

Wiki Article

4 Easy Facts About Dubai Company Expert Services Shown

Table of ContentsSome Ideas on Dubai Company Expert Services You Need To KnowAbout Dubai Company Expert ServicesThe 10-Second Trick For Dubai Company Expert ServicesThe smart Trick of Dubai Company Expert Services That Nobody is DiscussingDubai Company Expert Services Things To Know Before You Get This

Possession for this kind of firm is split based on stocks, which can be quickly gotten or marketed. A C-corp can raise funding by selling shares of stock, making this an usual service entity kind for large companies. S firms (S-corps) are similar to C-corps because the owners have restricted individual obligation; nevertheless, they stay clear of the concern of dual taxation.A restricted company is among one of the most popular lawful frameworks for all kinds as well as sizes of companies in the UK. This results from the several specialist and financial advantages it provides, all of which far go beyond those readily available to sole traders or specialists overcoming an umbrella firm.

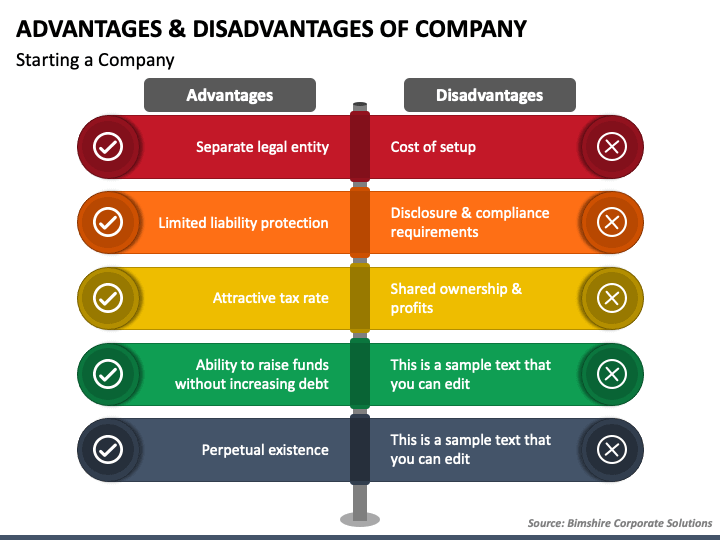

We will additionally outline the possible downsides of business development when compared to the sole investor structure. The primary factors for trading as a minimal firm are restricted obligation, tax obligation performance, and also professional condition. There are a number of other restricted business advantages available. Below, we discuss every one subsequently.

As a shareholder, you will certainly have no lawful responsibility to pay even more than the nominal worth of the shares you hold. If your company becomes insolvent and is unable to pay its lenders, you will just be called for to contribute the small worth of your unsettled shares. Past that, your individual possessions will be safeguarded.

Dubai Company Expert Services Things To Know Before You Buy

They are personally liable for any type of as well as all organization debts, losses, as well as obligations. As a single investor, there is no separation between you and also your organization. If business owes cash, you owe money. Consequently, your individual properties, including your house and financial savings, can be confiscated to pay your financial institutions.Whilst the activities, possession framework, and interior administration of your organization might be the same as when you were running as a single trader, firms are kept in a lot higher respect and develop a better impact. The difference in perception stems mostly from the reality that bundled businesses are a lot more carefully checked.

Reinvesting excess money, Rather than withdrawing all offered revenues yearly and also paying a lot more personal tax on top of your Corporation Tax liability, you can preserve surplus earnings in the business to pay for future operational costs and also growth. This makes more feeling than withdrawing all profits, paying greater rates of Earnings Tax obligation, and also reinvesting your own funds when business needs added funding.

In addition, the business won't have any kind of Company Tax obligation liability on the wage since incomes are a tax-deductible company expense (Dubai Company Expert Services). See likewise: You can take the remainder of your earnings as rewards, which are paid from earnings after the reduction of Company Tax. You will take advantage of the annual 1,000 dividend allocation (2023/24 tax year), so you will not pay any kind of individual tax obligation on the very first 1,000 of reward revenue.

The 25-Second Trick For Dubai Company Expert Services

Dividend tax prices are much reduced Extra resources than Revenue Tax rates. Depending on your annual revenues, you could save thousands of extra pounds in personal tax obligation annually by operating as a minimal firm instead of a single investor. Unlike the single investor structure, a restricted firm is a lawful 'person' in its very own right, with a totally different identification from its owners as well as supervisors.All firm names have to be entirely special, so no 2 firms can be established with the very same name, or even names that are really comparable to one another. The main name of your business can not be registered and also made use of by any kind of other business. A single trader's business name does not appreciate this protection.

There are some much less beneficial facets connected with limited company formation, as one would anticipate from anything that offers so numerous benefits. Many of these perceived drawbacks fade in contrast to the tax obligation advantages, enhanced expert picture, and limited liability protection you will appreciate.

Nevertheless, there is no lawful distinction in between business as well as the single investor. This indicates that you would be completely and also personally in charge of have a peek at these guys all business debts and obligations. Your home and also other possessions would go to danger if you were not able to satisfy your monetary commitments or if legal activity was taken against the company.

The 6-Second Trick For Dubai Company Expert Services

The sole trader framework is excellent for many local business owners, particularly consultants that have just a few customers and/or gain less than around 30,000 a year. However, there might come a time when it is monetarily or expertly advantageous to consider minimal company formation. If you reach that factor, your first port of phone call must be an accountant who can encourage on the best strategy.A restricted company likewise offers several tax obligation benefits; there are various benefits to having a distinguished specialist photo and standing; as well as, you can set up a firm for charitable or philanthropic purposes. The advantages must, however, be weighed against the additional time as well as cash needed for the additional management and accountancy demands you will need to manage.

This makes it the best structure for numerous freelancers as well as small company proprietors that are just starting, have very few clients, and/or generate yearly profits listed below a particular quantity. To choose the very best framework for your organization, your choice should be based upon your very own personal choices, in addition to expert, tailored suggestions from an accountant or advisor that has a clear understanding of your company objectives and lasting strategies.

The tax obligation year for Self Evaluation ranges from sixth April to 5th April the list below year (Dubai Company Expert Services). The present tax obligation year started on Sixth April 2023 as well as will end on 5th April 2024. You can submit your income tax return by article or online, and you can pay your Revenue Tax obligation as well as National Insurance payments digitally.

About Dubai Company Expert Services

If you miss out on the Learn More Here last filing due date by greater than 3 months, you will certainly get a 100 penalty. Nevertheless, this penalty may be waived if you make an attract HMRC. If you are late paying some or all of your tax, you might be billed a portion of the outstanding equilibrium.Report this wiki page